san francisco sales tax rate history

There are approximately 54126 people living in the South San Francisco area. City of South San Francisco Sales Tax Measure W November 2015 San Mateo County.

California City County Sales Use Tax Rates

Effective January 1 2013 the State rate increased by 025 for the Education Protection Account Proposition 30.

. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. The latest sales tax rates for cities starting with A in California CA state.

California City and County Sales and Use Tax Rates Rates Effective 04012017 through 06302017 1 P a g e Note. Proposition 172 1993 extended the state sales tax rate of 6 percent. The County sales tax rate is.

The South San Francisco California sales tax rate of 9875 applies to the following two zip codes. For example a 1000000 home has a transfer tax of 1100. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable.

DataSFs mission is to empower use of data. The highest sales tax in the state is Santa Fe Springs a LA County city with a rate of 1050 percent. Rates have not changed since FY 1993-94.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. Next to city indicates incorporated city City. Has impacted many state nexus laws and sales tax collection requirements.

California has a 6 sales tax and San Francisco County collects an additional 025 so the minimum sales tax rate in San Francisco County is 625 not including any city or special district taxes. Baker CA Sales Tax Rate. Anaheim 7750 Orange Anderson 7750.

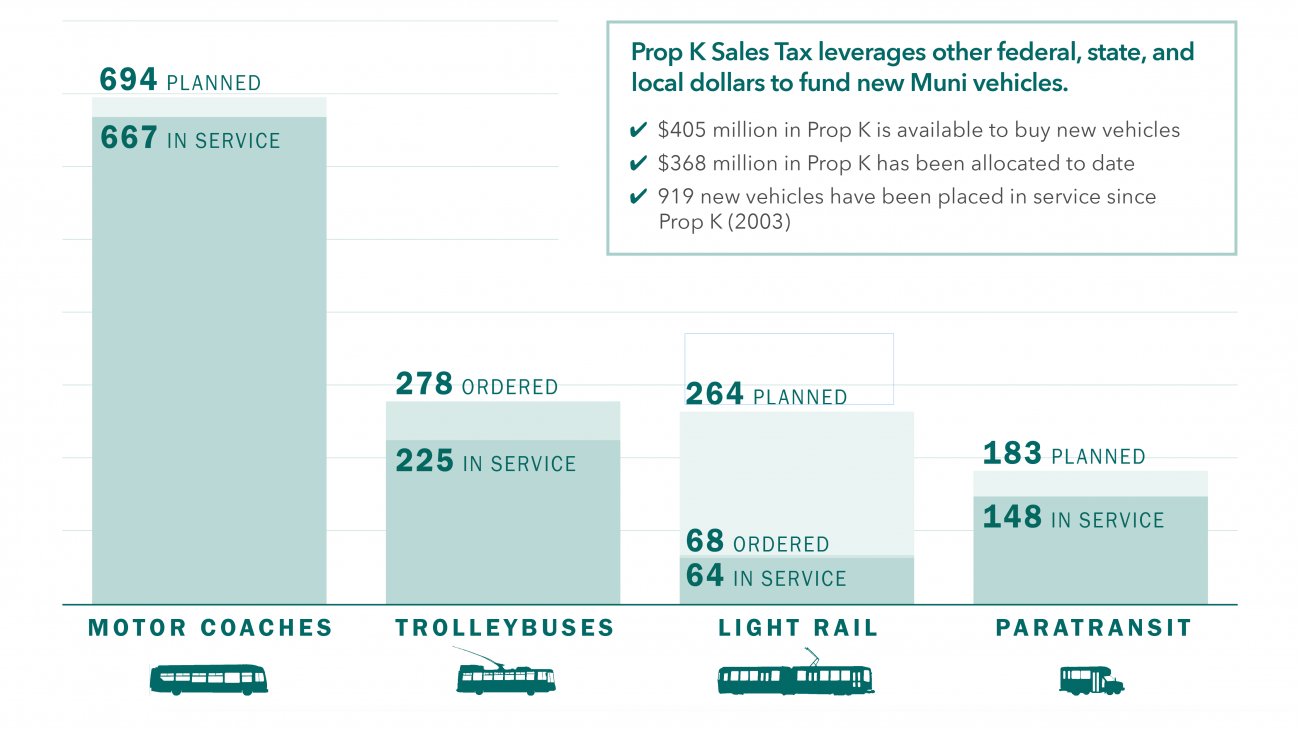

The 2018 United States Supreme Court decision in South Dakota v. This ultimately leads to increased quality of life and work for San Francisco residents employers employees and visitors. The San Francisco County Sales Tax is 025.

To review these changes visit our state-by-state guide. The San Francisco County Sales Tax is collected by the merchant on all. San Francisco City Hall is open to the public.

Angels Camp 7250 Calaveras. Historical CA Sales Tax Rate. 5 digit Zip Code is required.

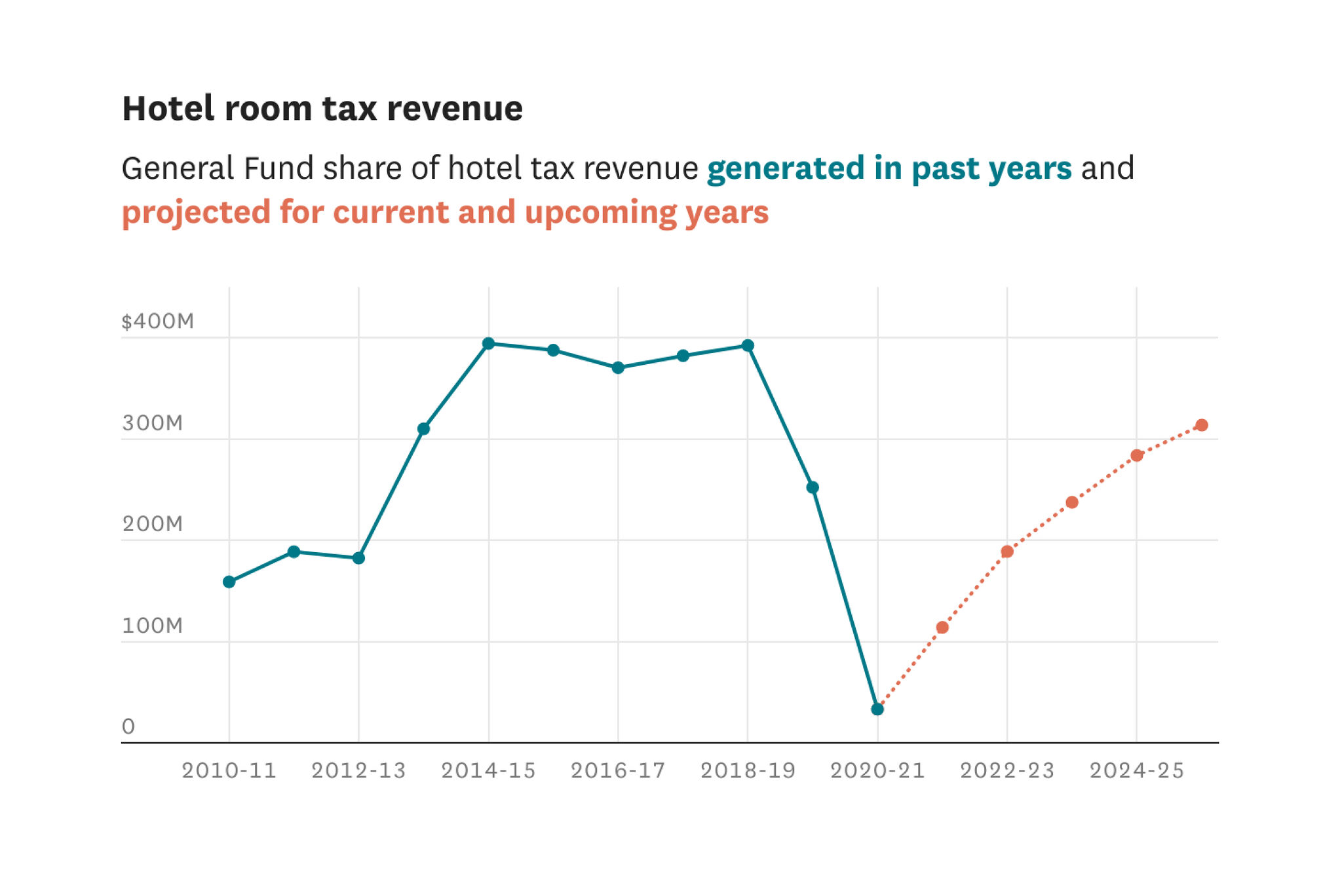

What is the sales tax rate in San Francisco California. 1933 the Los Angeles Times criticized the 250 sales tax rate in stating that the sales-tax rate should not have exceeded 1 per cent and that the tax rate was so high as to discourage. This scorecard presents timely information on economy-wide employment indicators real estate and tourism.

This is the total of state county and city sales tax rates. And Seattle Washington each with rates of 95 percent. Rates are for total sales tax levied in the City County of San Francisco.

Presidio of Monterey. East San Gabriel CA Sales Tax. The San Francisco sales tax rate is 0.

4 Utility Users Tax. These rates may be outdated. Cities at 10 percent.

Birmingham and Montgomery both in Alabama have the highest combined state and local sales tax rate among major US. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Blue Jay 7750 San Bernardino Blue Lake 7750 Humboldt Blythe 7750 Riverside Bodega 8125 Sonoma Bodega Bay 8125 Sonoma Bodfish 7250 Kern Bolinas 8250 Marin Bolsa 7750 Orange. Scroll below to view historical statewide sales tax propositions.

The estimated 2022 sales tax rate for 94080 is. The average sales tax rate in California is 868. The San Francisco sales tax rate is.

There is no applicable city tax. 9000 SAN LUIS OBISPO. 1788 rows California City County Sales Use Tax Rates effective April 1 2022.

City Rate County American Canyon 7750. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. Historical Tax Rates in California Cities Counties.

Rates include state county and city taxes. Did South Dakota v. How to calculate San Francisco sales tax.

Look up the current sales and use tax rate by address. We seek to transform the way the City works through the use of data. The total sales tax rate in any given location can be broken down into state county city and special district rates.

An alternative sales tax rate of 9875 applies in the tax region Daly City which appertains to zip code 94080. We believe use of data and evidence can improve our operations and the services we provide. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy.

The minimum combined 2022 sales tax rate for San Francisco California is. Highest and Lowest Sales Taxes Among Major Cities. To view a history of the statewide sales and use tax rate please go to the History of Statewide Sales Use Tax Rates page.

Bakersfield CA Sales Tax Rate. Portland Oregon and Anchorage Alaska. The California sales tax rate is currently.

It is customary for city transfer tax to be split 5050 by the seller and buyer. Concord 875 San Mateo County TBA 050 November 2018 ballot San Diego 775 Daly City 875 Denver 765 Redwood City 875 Miami 700 San Francisco 850 Boston 625 Walnut Creek 825 Washington DC 575 SourceNotes CURRENT Bay Area Sales Tax Rates and 2017 Sales Tax Ballot Measures1 ProposedEnacted Changes in Sales Tax Change in Sales. Our GIS-based sales tax website allows the user to view sales tax receipts from calendar.

Rate County Acampo. 2020 rates included for use while preparing your income tax deduction. As mentioned above some Bay Area cities charge an additional city transfer tax.

Act for the Government and Protection of Indians. Citys General Fund Local Portion is 1 of the total rate throughout the period shown. The average sales tax rate in California is 8551.

Automating sales tax compliance can help your business keep compliant with changing. The Bradley-Burns Uniform Local Sales. You can find more tax rates and allowances for San Francisco County and California in.

They are followed by Chicago Illinois. County transfer tax is typically 110 for every thousand dollars of the purchase price.

Understanding California S Property Taxes

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Understanding California S Property Taxes

Sales Tax Collections City Performance Scorecards

California Sales Tax Rates By City County 2022

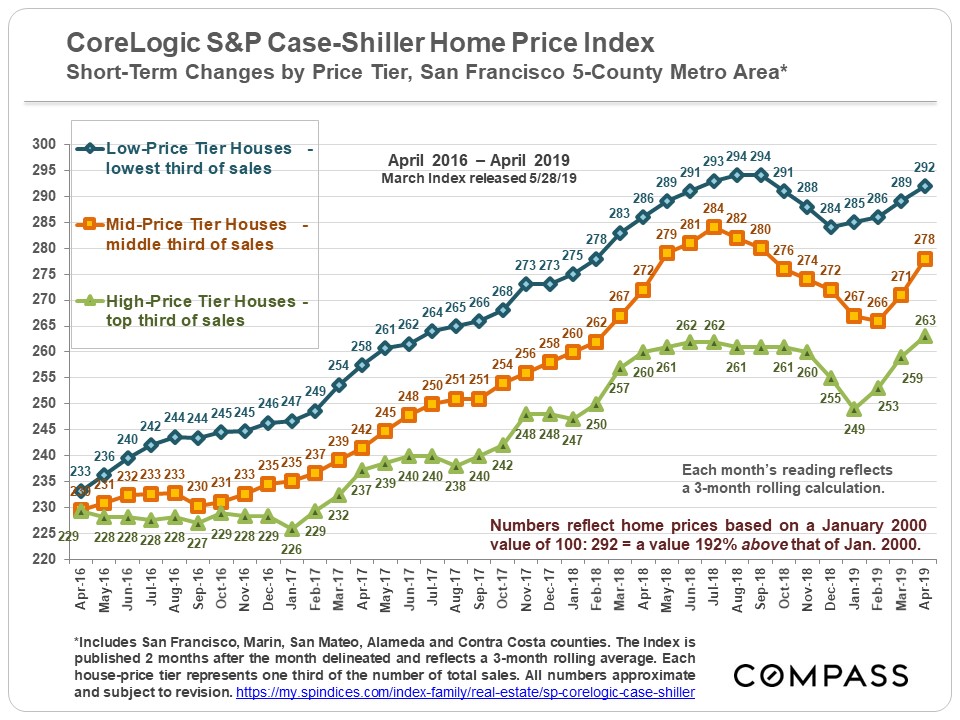

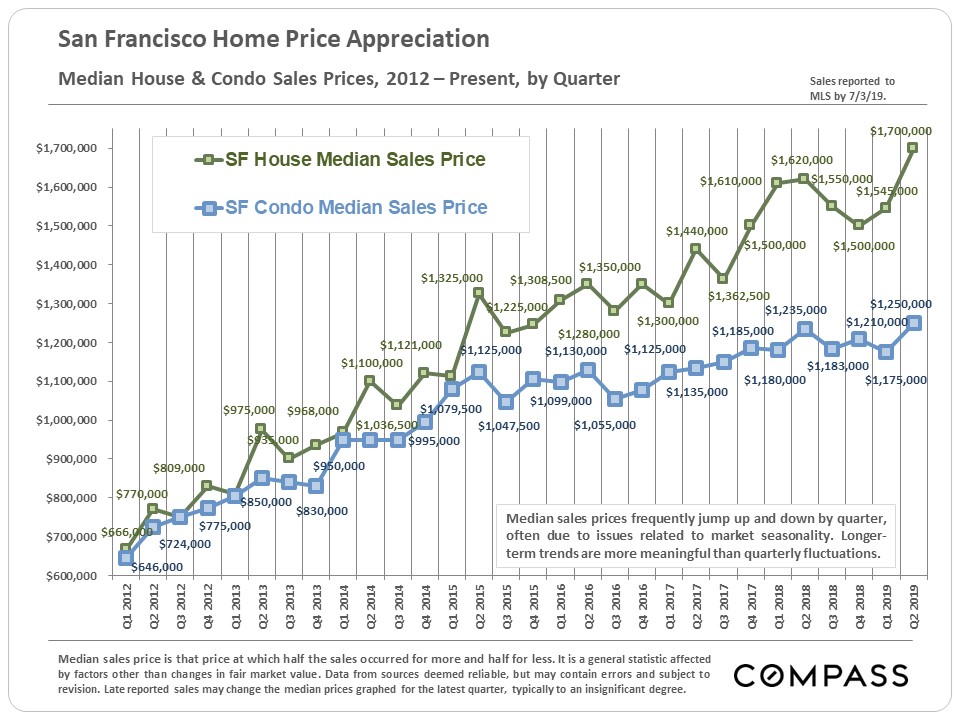

30 Years Of Bay Area Real Estate Cycles Compass Compass

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

30 Years Of Bay Area Real Estate Cycles Compass Compass

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Understanding California S Property Taxes

Understanding California S Property Taxes

States With Highest And Lowest Sales Tax Rates

San Francisco Is Projected To Have 6 3 Billion To Spend In 2022 2023 Here S How The Pandemic Is Impacting Those Numbers

Frequently Asked Questions City Of Redwood City